Based on what we saw on the 2015 International CES floor, the wellness and fitness category is on the verge of taking off in a big way. Some of these devices are “true” wearables in that they attach onto a body in some way—like a smartwatch, fitness band, eyewear, or a growing array of health and fitness sensor-based devices packaged in a variety of form factors including clothes. There are also other products that are at the edge of wearables, like various types of earphones, sensor-based basketballs and other equipment—and then there were also products that fall into the accessibility category. This related area, with a growing array of products, is also expected to become big business as baby boomers decide to age in their homes rather than being warehoused.

The abundance of all of these types of products on the show floor—and their revenue potential for the channel—is backed by newly released data from CEA. It is projecting that overall wearable unit sales will reach 30.9 million units (a 61 percent increase from last year) and will generate $5.1 billion in revenue in 2015 (a 133 percent increase).

Similarly, CEA expects that—thanks to strong sales for activity-tracking devices—the health and fitness wearables category will post a projected 20 million units to be sold in 2015. Revenues from the subcategory will be more than $1.8 billion. CEA also projects that smartwatches will take off in 2015, selling 10.8 million units (a 359 percent increase) and earning a projected $3.1 billion in revenue (a 474 percent increase over 2014).

These are large numbers—and huge jumps, on a year-to-year basis. We saw major brand names and mid-to-smaller companies jump into this marketplace. CES 2015 crystalized the fact that this product area is not going away; however, many generational developments are yet to take place until widespread adoption occurs. Also, we expect that new business models and monetization strategies will emerge for retailers as well as vendors.

As form factors and functionality continue evolving, certain trends relevant to retailers are unfolding. Fitness bands, for instance, have begun to stratify on price and also on functionality, with the release of the Samsung Gear Fit. The Gear Fit and several other similar models offer notification services for calls and texts as well as fitness-based functions, giving the ability in some cases to answer calls from the wrist. These expanded capabilities mean that the devices are moving into functions that, until now, have been the domain of smartwatches.

In a universe where traditional industry boundaries are disappearing and commoditization is becoming ever more commonplace, the customer experience provides the sizzle and differentiating factor for many of these fitness and wellness devices, smartwatches and fitness trackers—whether in a catalog, on a website, or in the store and on the floor.

In considering approaches to a customer experience—and as channels select products and product lines—given that these are personal products, there is a greater need for retailers to understand their customers.

Know Your Customer

Who is your customer? Male or female? Age range? Are they into sports? Are they health-conscious, geeks or early adopters of electronics? Are they infirm, pregnant or just want to stay in shape? What’s the range of price sensitivity? What matters more: features, brand name or price?

In many ways, while so many of these products get relegated to that drawer within six months, according to industry data, consumers keep buying them. The trick for retailers is to find the sweet spot between fitness functionality and also positioning these devices as attractive lifestyle products, or even jewelry. Just consider that consumers have more than one watch—based on form factor, looks, relevancy to a social situation, and so on. Similarly, many of these smartwatches may fall into this bailiwick as fashion meets wearables, like a smart watch bejeweled in Swarovski “diamonds.”

CES: A Major Showcase

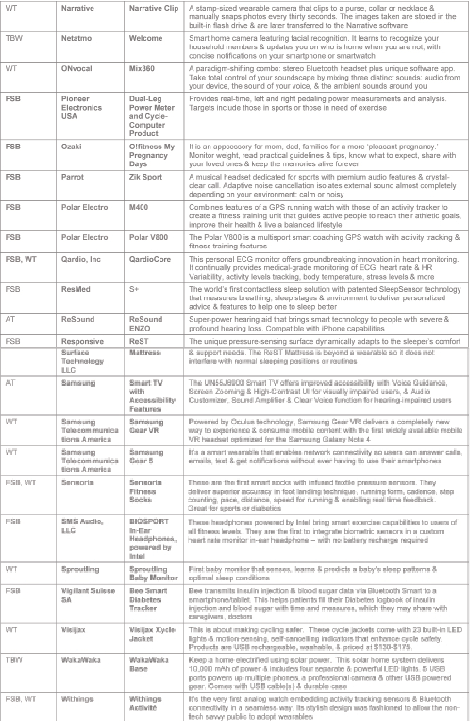

As retailers and channels look to find new business opportunities, a worthwhile metric for selecting products might be to consider the CES Innovation Award honorees in product categories related to fitness, wellness and even accessibility. It’s likely that the honoree vendors will provide additional promotional materials that will enhance the credibility and value of these new and growing product categories for your customers.

These honorees also provide insight into the blurring lines between wellness, fitness and accessibility, along with considering trends related to baby boomers wanting to age in their homes, devices for managing chronic diseases, and even for caring for pets. While many in the “Tech for a Better World” and Accessibility categories move beyond the major thrust of this article, they nonetheless present related or adjacent business development opportunities for channels in their communities such as physicians’ offices, senior centers, caregivers, parents with newborns, those concerned with child safety, and so on.

We are all just at the beginning of a journey into the world of wearables and other devices and apps that are designed to improve people’s lifestyles, as well as the growing quantified self-movement in relationship to one’s wellness and fitness.

This article would be incomplete without mentioning Apple, because we perceive that the launch of the Apple Watch will certainly increase consumer awareness and help to establish the sector as a mainstream product group.

Put that together with what we saw at CES, and it promises to be an exciting ride with many twists and turns as new revenue opportunities arise along the way.